Why Estimating Import Taxes Matters

If you’ve ever ordered something from outside Canada or had a package shipped to you, you’ve probably wondered, “How much tax will I have to pay?”

That’s why so many Canadians search for a Canada import tax calculator. The idea of having a simple tool to tell you the exact duty and tax sounds great.

But here’s the truth: there’s no single calculator that can cover all the details for every product, province, and shipping method. Import taxes depend on many factors, and every shipment is different.

The good news? You don’t need an official calculator to get a good estimate. In this guide, we’ll show you how you can figure out your potential import duties and taxes manually, and how DTDC FineEx Couriers can help make the whole process easier.

What Are Import Taxes & Duties in Canada?

Whenever goods enter Canada, they may be subject to certain fees:

- Duties: This is a percentage of the product’s value, based on its type and origin.

- GST/HST: A goods and services tax (or harmonised sales tax) based on the product’s value and the province you live in.

- Excise Tax: An Additional tax on specific items (such as alcohol or tobacco).

- Brokerage & Handling Fees: Fees charged by the courier or customs broker for processing your package through customs.

These fees are set by the Canada Border Services Agency (CBSA).

- You can read more here on the CBSA’s official site.

Why Is There No Canada Import Tax Calculator?

Many shoppers search for a Canada import tax calculator, expecting to find an easy tool like a currency converter. But here’s why no official calculator exists:

- Duty rates vary by product type, using something called HS codes (Harmonised System codes).

- Taxes vary by province — GST in Alberta is different from HST in Ontario.

- Country of origin matters — Some goods are tax-exempt if coming from countries with free trade agreements.

- Shipping method affects fees — courier shipments are treated differently from postal ones.

This is why it’s impossible to create a simple calculator that works for every scenario.

How to Manually Estimate Your Import Duties & Taxes (Without a Calculator)

Even though there’s no magic tool, here’s a practical way to get a good estimate:

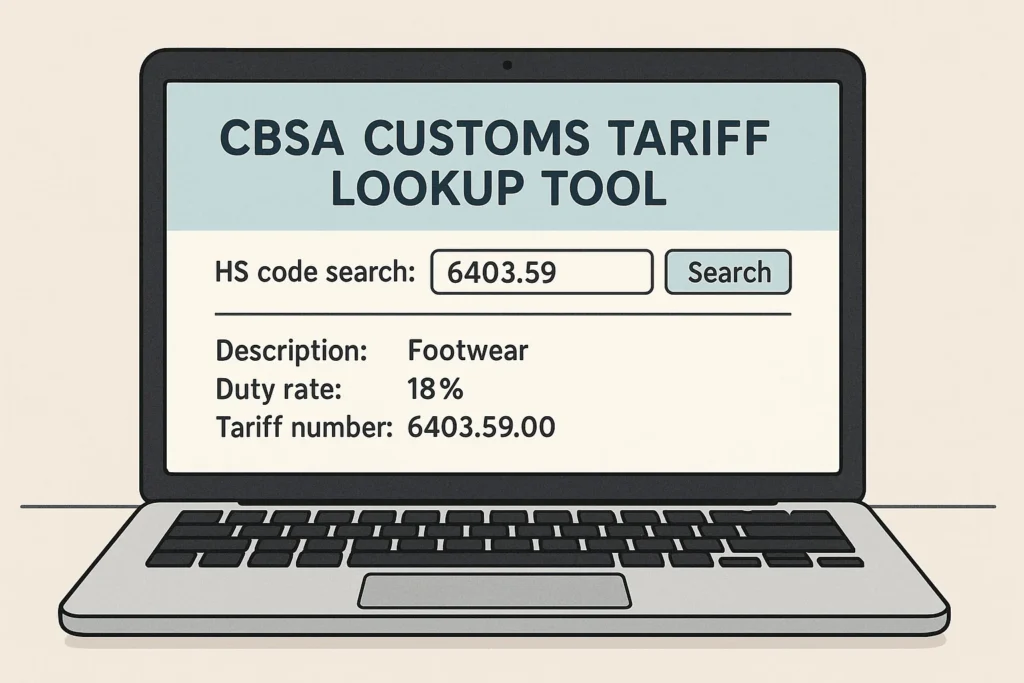

1. Identify the Product’s HS Code

The HS code determines the duty rate for your product. You can look this up using the CBSA Customs Tariff Tool.

Example:

- Shoes → HS code 6403 → duty rate approx. 18%

2. Determine the Declared Value

This is usually the price you paid for the item, in Canadian dollars.

Example: a $200 pair of shoes.

3. Apply the Duty Rate

If shoes have an 18% duty rate:

$200 × 18% = $36 duty.

4. Calculate GST/HST

Add GST or HST on the total of (item value + duty). The rate depends on your province:

- Alberta: 5% GST

- Ontario: 13% HST

- British Columbia: 5% GST + 7% PST

Example for Ontario:

($200 + $36) × 13% = $30.68 GST/HST.

5. Add Any Excise or Brokerage Fees

If your item is alcohol or tobacco, excise tax applies.

Also, courier companies (like us!) usually charge a brokerage fee for handling customs clearance — this varies by courier. At DTDC FineEx, we keep these fees affordable and transparent.

Common Mistakes to Avoid

When trying to estimate your import costs, watch out for these common errors:

- Under-declaring the value: Can lead to penalties or delays. Always declare the true purchase value.

- Ignoring country of origin: Some goods from certain countries are exempt from duties.

- Forgetting courier handling fees: These are in addition to government taxes and duties.

- Assuming all items are taxed the same, some products have higher rates or special taxes.

How DTDC FineEx Couriers Can Help You

At DTDC FineEx Couriers, we understand that navigating import taxes and duties can feel overwhelming, especially when there’s no easy Canada import tax calculator to rely on.

Here’s how we make things simpler:

- Expert guidance: We help you understand potential duties and taxes before you ship or receive goods.

- Customs clearance support: Our team works directly with CBSA to ensure your package is cleared smoothly.

- Transparent fees: No hidden costs — we explain all brokerage and handling fees upfront.

- Reliable international shipping: Whether you’re importing gifts, personal items, or commercial goods, we ensure fast and safe delivery.

Learn more about our international courier services or contact us for personalised help.

Conclusion

While an exact Canada import tax calculator doesn’t exist, you can still estimate your import costs by following the steps in this guide.

At DTDC FineEx Couriers, we’re here to help you every step of the way, whether you’re shipping across borders, managing customs paperwork, or figuring out potential fees.

If you have any questions, don’t hesitate to get in touch with us — our team is always happy to help.

Frequently Asked Question on Canada import tax calculator (FAQs)

Is there an official Canada import tax calculator?

No, there is no official universal tool. Import taxes depend on product type, value, origin, and province. This guide helps you estimate manually.

How can I find out the duty rate for my product?

You can use the CBSA Customs Tariff Tool to look up duty rates based on HS codes.

What taxes will I pay when importing goods to Canada?

You may pay duties, GST/HST, excise taxes (for certain items), and a courier brokerage fee.

Can DTDC FineEx help me understand my import costs?

Yes! Our team offers clear guidance and personalised support so you know what to expect before your shipment arrives.

0 Comments